Newsletter

Financial Wellness Starts Here

Section: Infographic of the week

← Curating the web to find the most interesting and helpful

information about your money.

The Average Income Tax by Wealth Bracket in America

Overall, the top 1% of earners paid $864 billion in income tax, the highest share across wealth brackets. The average income tax paid across this group was nearly $562,000. That year, about 1.5 million people fell into this echelon, paying an average income tax rate of 26.1%. This graphic shows the average federal income tax by wealth bracket in America, based on data from the IRS via the Tax Foundation.

Across all Americans, the average income tax rate stood at 14.5% →

Across all Americans, the average income tax rate stood at 14.5% →Financial wellbeing is the top challenge faced by employees, yet employers struggle to address this issue

Financial health is the top wellbeing concern for employees, but many employers acknowledge a gap in effectively addressing this issue.

How Far $1 Million Gets You in Retirement, by U.S State

Becoming a millionaire has long been a dream for people worldwide. In most cases, the million-dollar mark is seen as a symbol of financial success and prosperity. However, with the rising costs of housing, healthcare, and food, is $1 million really enough to stop working? This graphic illustrates how long $1 million, combined with Social Security benefits, would last in each U.S. state, according to data from GOBankingRates. The analysis includes groceries, healthcare, housing, utilities, transportation, and miscellaneous expenses.

In three states—Massachusetts (19 years), California (16 years), and Hawaii (12 years)—$1 million would be completely spent in less than 20 years →

In three states—Massachusetts (19 years), California (16 years), and Hawaii (12 years)—$1 million would be completely spent in less than 20 years →Daily Travel Budgets for 15 European Countries

European countries are among the most sought-after destinations for tourists worldwide. In 2023 alone, Europe saw over 700 million international tourist arrivals. This map presents the costs of accommodation, food, and transport for tourists in 15 European countries, as compiled by HelloSafe in September 2024. Airfare is excluded.

Switzerland is the Most Expensive Destination →

Switzerland is the Most Expensive Destination →College Budgeting

Save money in college by cooking your own food, renting or borrowing textbooks, using your student discount, and more.

The College Money Saver Checklist →

The College Money Saver Checklist →Mapped: The Top 10 States by Credit Card Spending

Americans spend an average of just over $5,200 per month on their credit cards across all states. Which states have the highest credit card spending?

States with the highest credit card spending →

States with the highest credit card spending →The Most Affordable ZIP Code for Renters by State

The cost of renting is anything but uniform—shaped by geography, neighborhood trends, and even the quirks of a few city blocks. What’s affordable in one part of town might be out of reach just a short walk away. This map, created by NeoMam Studios for CashNetUSA, visualizes the most affordable ZIP codes to rent across America.

The Most Affordable ZIP Codes in Each U.S. State →

The Most Affordable ZIP Codes in Each U.S. State →Visualizing How Americans Spend Their Money

Today, consumer spending represents 68% of U.S. GDP, with much of this used for housing, transportation, and healthcare costs. More than ever, Americans are using debt and credit cards to fund these purchases. In the second half of 2024, household debt hit a record $17.9 trillion. At the same time, credit card debt surpassed a historic $1 trillion, climbing by 8.3% over the time period.

Discover how simple it is to track your spending and compare it daily, monthly, or yearly with Neontra →

Discover how simple it is to track your spending and compare it daily, monthly, or yearly with Neontra →How the Cost of Netflix Has Increased Over Time

This graphic shows how the price of Netflix plans in the U.S. have increased over time. This data was compiled by Android Authority

Neontra is the easiest way to track subscriptions, manage bills, and your recurring charges in one place →

Neontra is the easiest way to track subscriptions, manage bills, and your recurring charges in one place →Ranked: The 25 Least Affordable Cities in America from the visualcapitalist.com

Inflation may have come down from its post-pandemic highs, but Americans are still feeling the effects of the rapid price rise in the last three years. And some places in the country are simply more expensive than others due to larger populations, more economic opportunities, desirable communities, and high taxes.

California alone has five of them, led by San Jose, where households spend nearly $3,700 dollars a month →

California alone has five of them, led by San Jose, where households spend nearly $3,700 dollars a month →Visualizing Major Asset Class Returns in 2024

Bitcoin surged to all-time highs, gold saw its best performance in 14 years, and the U.S. dollar rallied thanks to a strong U.S. economy. Meanwhile, the S&P 500 saw its best two-year run in over 25 years. On the flip side, bonds experienced lackluster performance amid reflationary concerns. This graphic shows major asset class returns in 2024, based on data from TradingView.

Bitcoin and Gold Outperform in 2024 →

Bitcoin and Gold Outperform in 2024 →Financial Literacy 101: What Every College Student Needs to Know by StudyCorgi

StudiCorgi has put together a list of practical strategies to help college students become more financially savvy and develop a healthy money mindset that lasts well beyond their college years. Their visual guide outlines the benefits of financial literacy and the key principles that will enable young adults to manage their finances effectively.

Benefits of financial literacy for college students →

Benefits of financial literacy for college students →The Cost of Raising a Child, by U.S. State

Although costs vary from family to family, two working parents spend an average of around $23,000 per year raising one child in the United States. This graphic illustrates the cost of raising a child by state, based on data compiled by SmartAsset as of February 2024.

How does your home State compare? →

How does your home State compare? →Mapped: America’s Happiest States in 2024

Decades of research have found that the predictors of happiness stem from many interwoven factors, such as the quality of a person’s relationships to financial stability.

This graphic shows happiness levels by U.S. state in 2024, based on data from WalletHub →

This graphic shows happiness levels by U.S. state in 2024, based on data from WalletHub →Mapped: The Average Credit Card Debt in Every U.S. State (2024)

This map visualizes the average credit card debt held by households in each U.S. state and ranks the states where residents pay off the debt the fastest and slowest. Data is sourced from Bankrate (2024) who also used average monthly household income to calculate how long it takes to pay off balances.

Where does your State rank? →

Where does your State rank? →Mapped: Median Home Sale Price by U.S. State

In 2024, buying a home in the U.S. looks vastly different depending on where you are. Factors like local demand, land availability, economic conditions, and housing regulations all contribute to the median home prices in each state.

Which States Have the Highest Home Sales Prices? →

Which States Have the Highest Home Sales Prices? →Ranked: U.S. States vs. G7 Countries by GDP per Capita

This graphic charts the GDP per capita of G7 countries against select U.S. states. Why compare states vs G7? By going down to the state level we account for differences in population and aggregate demand which can mask output inequalities between the U.S. and its peer economies.

How does your State compare? →

How does your State compare? →Which Assets Are Most Correlated to the USD?

Building a well-balanced, diversified portfolio involves including assets with varying correlations. The U.S. dollar (USD), with its weak or negative correlations to other assets, can be a valuable addition to investors’ portfolios. This graphic, created in partnership with OANDA, illustrates the USD’s correlations with other assets and indices. This insight can provide assistance for evaluating the role of USD in investment portfolios.

Which Assets Are Most Correlated to the USD? →

Which Assets Are Most Correlated to the USD? →Mapped: How Much Americans Spend on Groceries in Each State

Since August 2020, prices for “food at home” (groceries) have increased by 20% according to data from the Bureau of Labor Statistics, the steepest inflation seen since the 1970s. On average, American households are paying about $270 per week ($1,080 a month) for groceries, according to Delish, which sourced their findings from the latest Census Bureau estimates.

U.S. States by Weekly Grocery Bills →

U.S. States by Weekly Grocery Bills →Mapped: Fastest Growing (and Shrinking) Cities in the U.S. and Canada

Despite Canada having a population just 12% the size of the United States, the country was home to a majority of the fastest-growing cities between the two neighbouring countries.

Toronto is the Fastest-Growing City in Canada and the U.S. →

Toronto is the Fastest-Growing City in Canada and the U.S. →The American Dream Costs $4.4 Million

This graphic shows the estimated cost of the American dream per household over the course of their lifetime, based on analysis from Investopedia.

The cost of the American dream exceeds the average lifetime salaries of both men ($3.3 million) and women ($2.4 million) with a Bachelor's degree →

The cost of the American dream exceeds the average lifetime salaries of both men ($3.3 million) and women ($2.4 million) with a Bachelor's degree →Global Real Estate Bubble Index 2024

This graphic shows real home price growth in real estate bubble markets over the last decade

Where do American cities rank? →

Where do American cities rank? →Which States Have The Highest Share of Retirement-Age Workers?

About 22% of American adults 65 and older continue to work in 2024. Growth in the 65 and older population, higher cost of living and other factors have led to a large share of older adults in the workforce. New Jersey saw the highest share of working adults over the age of 65 in 2024, and the largest two-year increase.

Retirement-Age Adults Still Working by State →

Retirement-Age Adults Still Working by State →Charted: The Most Popular Investing Strategies, by Generation

When it comes to investing, each generation has their own mix of strategies, and younger generations like to try a bit of everything.

How Do Different Generations Invest Their Money? →

How Do Different Generations Invest Their Money? →Ranked: Countries by Wealth Disparity Changes (2008–2023)

A recent US Federal Reserve analysis found that from 2019 to 2022, low-wealth groups in America had larger percentage gains in wealth compared to their high-wealth counterparts.

How Wealth Inequality Has Changed Since 2008, by Country →

How Wealth Inequality Has Changed Since 2008, by Country →Charted: Average Wage Growth in G7 Countries (2000-2022)

Average wage growth is a key sign of how well a country’s economy is doing. When wages rise, it typically signals that businesses are thriving and can afford to pay their employees more, which in turn boosts consumer spending and stimulates further economic growth.

How does your wage growth compare? →

How does your wage growth compare? →Ranked: The Worst U.S. States for Retirement

This chart ranks the 10 worst U.S. states to retire in, according to Bankrate.com, as of 2024. What this ranking is not showing are states that people prefer to retire in for more qualitative reasons. Factors like weather are considered, but financial aspects of a state are weighted higher in this ranking.

This chart ranks the 10 worst U.S. states to retire in 2024 →

This chart ranks the 10 worst U.S. states to retire in 2024 →Mapped: U.S. States With the Most Million-Dollar Homes by visualcapitalist.com

Million-dollar homes are becoming more common, with the U.S. having 621 cities where a typical home is worth $1 million or more.

This graphic shows the number of cities in each U.S. state where a typical home costs $1 million or more →

This graphic shows the number of cities in each U.S. state where a typical home costs $1 million or more →How Much Does it Take to Be Wealthy in America? by the visualcapitalist

The is graphic looks at data from the 2023 Modern Wealth Survey by Charles Schwab, which asks respondents what net worth is required to be considered wealthy in America.

Wealthy in America: A Closer Look →

Wealthy in America: A Closer Look →The Countries With the Highest Wealth per Person

In 2023, global wealth increased by 4.2% as global stock markets rebounded and inflation eased. While Europe, the Middle East, and Africa achieved the strongest wealth growth, the U.S. accelerated at roughly half the rate of these regions, at 2.5% annually.

Highest average wealth per person, by country. Where does your country rank? →

Highest average wealth per person, by country. Where does your country rank? →Where Are Salaries the Highest?

Broadly speaking, average salaries are going to be higher in countries with a higher cost of living. For example, Switzerland is one of the most expensive countries to live in, with monthly living costs of $2,497 USD according to World Population Review.

The average annual salaries of OECD countries →

The average annual salaries of OECD countries →Charted: American Stock Ownership Back at All-Time Highs

This graphic shows the share of U.S. households’ finances invested in public stocks over time, based on data from the Federal Reserve.

Share of U.S. households’ finances invested in public stocks over time →

Share of U.S. households’ finances invested in public stocks over time →Mapped: The Salary Needed to Buy a Home in 50 U.S. Cities in 2024

In 2024, the median salary for the typical American home buyer has risen to $104,339—up from $88,000 just two years prior.

The Cost of American Home Ownership by State in 2024 →

The Cost of American Home Ownership by State in 2024 →The World’s Least Affordable Housing Markets in 2024

Many cities around the world have become very expensive to buy a home in, but which ones are the absolute most unattainable?

Impossibly unaffordable cities, where does your city rank →

Impossibly unaffordable cities, where does your city rank →Ranked: Countries With the Most Millionaires and Billionaires

This graphic lists the top 12 countries by number of high net worth individuals (HNWIs). An HNWI is someone with liquid investable wealth of $1 million USD or more.

Where do the wealthy live? →

Where do the wealthy live? →Visualizing the Tax Burden of Every U.S. State

This map graphic visualizes the total tax burden in each U.S. state as of March 2024, based on figures compiled by WalletHub.

There are several other U.S. states that don’t charge income taxes →

There are several other U.S. states that don’t charge income taxes →Charted: The Death of Cash Transactions Around the World

As credit cards and digital wallets (e.g. Apple Pay, Paytm, Alipay) see increasing adoption around the world, the share of cash being used in transactions is plummeting. The chart above looks at cash as a share of transaction value in selected countries at three time periods (2019, 2023, and 2027P).

Cash Transactions are Becoming More Rare Around the World →

Cash Transactions are Becoming More Rare Around the World →Visualized: How Long Can Each Generation Survive Without Income?

The Visual Capitalist has partnered with Lloyd’s Register Foundation to explore economic resilience further and determine how long the average person can afford to cover their needs without income.

How long survey respondents could afford to cover basic needs if they lost all income →

How long survey respondents could afford to cover basic needs if they lost all income →Charted: U.S. Wealth by Generation

In 2023, American Baby Boomers owned 52% of the country’s net wealth despite comprising only 20% of the population. Based on Federal Reserve data, this graphic illustrates the distribution of wealth in the United States from 1990 to 2023 by generation.

Baby Boomers Own Over Half of the Wealth →

Baby Boomers Own Over Half of the Wealth →Visualized: The Growth of Clean Energy Stocks

Over the last few years, energy investment trends have shifted from fossil fuels to renewable and sustainable energy sources. Long-term energy investors now see significant returns from clean energy stocks, especially compared to those invested in fossil fuels alone. For this graphic, Visual Capitalist has collaborated with EnergyX to examine the rise of clean energy stocks and gain a deeper understanding of the factors driving this growth.

The Growth of Clean Energy Stocks →

The Growth of Clean Energy Stocks →Overdraft Protection: What your bank doesn't want you to know

Nobody wants the embarrassment of seeing their debit card declined. To help, bankers came up with a seemingly beneficial solution. Overdraft protection is a service that allows card users to pay for items even if they temporarily do not have the funds, and it can help consumers potentially avoid such awkward problems. However, what seemed like a good idea may have been taken too far: and now, overdraft protection is a key source of profits for banks.

How overdraft protection works, and why it tends to hurt consumers more than it helps →

How overdraft protection works, and why it tends to hurt consumers more than it helps →Visualizing the extraordinary power of compound interest by the Visualcapitalist

The power of compound interest is so compelling, that it’s been often called the “eighth wonder of the world”. Find out why this concept is so fundamental to personal finance in the following infographic:

The power of compound interest →

The power of compound interest →Navigating the personal finance landscape requires skills or knowledge in the following foundational areas

Personal finance isn’t just about dollars and cents. The reason it’s so hard to master? It’s actually a multi-disciplinary field that requires foundational skills ranging from psychology to negotiation.

Navigating the personal finance landscape requires skills or knowledge in the following foundational areas →

Navigating the personal finance landscape requires skills or knowledge in the following foundational areas →Mapped: The Income a Family Needs to Live Comfortably in Every U.S. State by the Visual Capitalist

This was originally posted on the Voronoi app. Families in the top five most expensive U.S. states require an annual income exceeding $270,000 to live comfortably. This visualization illustrates the income necessary for two working adults with two children to maintain a comfortable lifestyle in each state.

The income a family needs to live comfortably in every U.S. State →

The income a family needs to live comfortably in every U.S. State →Visualizing America’s Average Retirement Savings, by Age

Painting a concerning picture, the median retirement savings for Americans stands at a mere $87,000, a figure far lower than what is needed for a comfortable nest egg. This savings gap—the amount people have actually saved versus what they believe is needed for retirement—is significantly rising. In fact, a recent survey from Northwestern Mutual reveals that $1.46 million is the ideal savings target for retirement, up from $1.27 million last year.

America’s Average Retirement Savings, by Age →

America’s Average Retirement Savings, by Age →The Top 5 Reasons People Hire a Financial Advisor

From saving for a down payment to planning for retirement, clients turn to advisors to guide them through life’s complex financial decisions. However, many of the key reasons for hiring a financial advisor stem from emotional factors and go beyond purely financial motivations.

Investors' motivations for working with an advisor go beyond financial reasons →

Investors' motivations for working with an advisor go beyond financial reasons →Charted: Who Has Savings in This Economy?

The Visualcapitalist visualises the percentage of respondents to the statement “I have money leftover at the end of the month” categorized by age and education qualifications. Data is sourced from a National Endowment for Financial Education (NEFE) report, published last month.

The Impact of Higher Education on Earnings and Savings →

The Impact of Higher Education on Earnings and Savings →Where Does One U.S. Tax Dollar Go?

Come tax season, a common refrain is: “what do my taxes even pay for?” To answer that question, we visualized U.S. federal government spending by function, referencing expenditure to a single federal tax dollar. Data is for the fiscal year ending September 30, 2023 from the U.S. Bureau of the Fiscal Service. Total spending amounts are converted to cents on the dollar and percentages, to show where one tax dollar goes.

Major Areas of U.S. Government Spending →

Major Areas of U.S. Government Spending →Visualizing the Growth of $100, by Asset Class

Which major asset class has generated the strongest returns over the long run? How do the returns of investments like bonds and real estate actually stack up? To put investment returns in perspective, this graphic shows the growth of $100 by asset class over the long term, based on data from Aswath Damodaran at NYU Stern.

Comparing Asset Class Returns →

Comparing Asset Class Returns →A Map of Global Happiness By Country in 2024

Happiness, like love, is perhaps one of the least understood and most sought-after emotions and experiences in human life. And while many inspiring teachings exist about attaining individual happiness, it’s worthwhile to consider how happy entire countries are on a collective scale.

A Map of Global Happiness By Country in 2024 →

A Map of Global Happiness By Country in 2024 →Who Expects to Get Richer in 2024, by Both Generation and Gender

The Visualcapitalist plots the percentage of high net worth individual (HNWI) respondents who expect their wealth to increase in 2024, categorized by generation and gender, from the Knight Frank Next Gen Survey, accessible in their latest wealth report.

Who Expects to Get Richer in 2024, by Generation and Gender →

Who Expects to Get Richer in 2024, by Generation and Gender →Chart: The Declining Value of the U.S. Federal Minimum Wage

This graphic illustrates the history of the U.S. federal minimum wage using data compiled by Statista, in both nominal and real (inflation-adjusted) terms. The federal minimum wage was raised to $7.25 per hour in July 2009, where it has remained ever since.

Nominal vs. Real Value of the U.S. Federal Minimum Wage →

Nominal vs. Real Value of the U.S. Federal Minimum Wage →Decision Paralysis: The Rise to One Million Investment Choices

There were just over 30,000 managed investment products in 2002, but the choices grew rapidly in the years that followed. As of June 30, 2023, there were more than 742,000 products available.

The rise in investment products over time, and how financial advisors can help →

The rise in investment products over time, and how financial advisors can help →Ranked: What People Value Most in a Financial Advisor

Are advisors putting their focus where it matters? You might think that positive reviews and recommendations would be a top consideration for people choosing a financial advisor. However, other qualities appear to be much more important.

The Qualities Investors Value in a Financial Advisor →

The Qualities Investors Value in a Financial Advisor →Charted | The Wealth Needed to Join the Top 1%, by Country

The last decade has witnessed a remarkable surge in the global number of millionaires. By 2022, 1.1% of the world’s adults were millionaires, up from 0.6% in 2012. So, how to know if you belong to the top 1% in your country?

Wealth Needed to Join the Top 1%, by Country →

Wealth Needed to Join the Top 1%, by Country →Mapped: Inflation Projections by Country, in 2024

While inflation looks to be easing, there remains the risk of a second wave of price pressures driven by geopolitical conflicts and supply disruptions in the Red Sea. Adding to this, a stronger than expected labor market could drive consumer demand, pushing up higher prices. This graphic shows 2024 inflation projections around the world, based on forecasts from the International Monetary Fund (IMF).

Inflation Projections, by Country in 2024 from the Visual Capitalist →

Inflation Projections, by Country in 2024 from the Visual Capitalist →Mapped: Which is the Best U.S. City for Entry-Level Jobs by Pay?

The anxieties around a first-job are immense: fear of the unknown, performance pressure, and the need to navigate new professional environments. But good pay can help manage these worries. Lots and more has been written on which careers are the highest-paid, but how does geography factor into the equation?

Ranked: 50 U.S. Cities By Entry-Level Job Pay →

Ranked: 50 U.S. Cities By Entry-Level Job Pay →How Much Do Text Message Scams Cost Americans?

The Visualcapitalist visualizes the amount of money that Americans lost from scam text messages in the year 2022. These figures are sourced from reports filed to the Federal Trade Commission (FTC), accessed via USA Facts.

Type of Text Message Scams by Cost to Americans →

Type of Text Message Scams by Cost to Americans →Charted: Investment Preferences by Generation in the U.S.

Different generations grow up with different values and different economic realities, causing investment preferences by generation to vary across the board. The above graphic shows how different generations invest—from millennials to boomers—based on June 2023 survey data from Charles Schwab.

The Visual Capitalist: Investment Preferences by Generation →

The Visual Capitalist: Investment Preferences by Generation →What are people’s biggest financial stressors?

The route to financial happiness isn’t the same for everyone, though 81% of Americans agree that inflation and the rising cost of goods generate the most stress. But different trends emerge when we compare the generations.

Financial stress is such a challenge that many plan to retire three years later than planned →

Financial stress is such a challenge that many plan to retire three years later than planned →The Happiness Index

Across generations, Americans are tending to find happiness in areas other than their finances. The financial situation is especially challenging for Gen Z and X; less than half report being satisfied with their finances.

How, then, can someone stay on the road to financial happiness? →

How, then, can someone stay on the road to financial happiness? →How to Reach Financial Happiness

Many Americans believe that you need $1.2 million to reach financial happiness. So, it follows that 71% of Americans feel more money would solve their problems. This leaves us to wonder: how happy are Americans with their finances?

What makes people financially happy? →

What makes people financially happy? →Retirement Planning Mistakes

According to professionals, the most common retirement planning mistakes are time-related, like outliving savings or not understanding how inflation can affect a portfolio over time. The number one mistake? According to 49% of financial planners, its underestimating the sizeable impact inflation has on the value of retirement savings.

Charted: Top 10 Retirement Planning Mistakes from the visualcapitalist.com →

Charted: Top 10 Retirement Planning Mistakes from the visualcapitalist.com →Visualizing the Global Education Gap

The global education gap refers to disparities in educational access that exist between higher- and lower-income countries. It exists for various reasons, including lack of resources, political instability, and outdated technology.

The Hinrich Foundation provides visual context to the global education gap →

The Hinrich Foundation provides visual context to the global education gap →Tech Giants’ Stock Performance: A Three-Year Review (2020-2023)

In the last three years tech giants like Apple, Google, and Microsoft navigate through market volatility due to the global pandemic. In 2020, the pandemic led to a market selloff, but companies like Zoom and Shopify experienced growth due to increased demand during lockdowns.

Maureen Okonkwo's Viz at Tableau Public →

Maureen Okonkwo's Viz at Tableau Public →Holiday Survival Guide

The winter holiday shopping season is the most expensive time of year for most households. This year, spending is expected to be even higher due to rising prices. This infographic helps you start planning to shop and save for the 2023 holiday season.

How to plan and save for the 2023 holiday shopping season →

How to plan and save for the 2023 holiday shopping season →How Americans of Different Generations Spent Their Money in 2021

Most consumer spending falls into the larger categories of food, housing, transportation, healthcare, and other goods and services.

View the interactive version of this chart highlighting how different generations spend money →

View the interactive version of this chart highlighting how different generations spend money →What You Need to Earn to Own a Home in 50 American Cities

Between skyrocketing prices, stagnating wages, and now rising interest rates, the deck seems to be increasingly stacked against home ownership. Using May 2023 data tabulated by Home Sweet Home, the Visual Capitalist maps out the annual salary needed to afford a 30-year mortgage (at 6.37%) to buy a home in America’s 50 most populous metropolitan areas.

The Least and Most Affordable American Cities to Own a Home →

The Least and Most Affordable American Cities to Own a Home →Visualizing the Pyramid of Global Wealth Distribution

Who controls global wealth? In 2022, the world’s millionaires held nearly half of net household wealth. Decades of low interest rates led equities and real estate values to soar, and these assets are disproportionately held among the world’s wealthiest.

The distribution of global household wealth, based on the annual 2023 UBS Global Wealth →

The distribution of global household wealth, based on the annual 2023 UBS Global Wealth →Visualizing 30 Years of Investor Sentiment

The link between investor sentiment and the stock market is not linear. In fact, many consider extreme sentiment readings as a contrarian indicator. If sentiment swings sharply in one direction, some investors may consider this a signal to do the reverse.

Investor sentiment and U.S. stock prices over modern history →

Investor sentiment and U.S. stock prices over modern history →The 20 Most Common Investing Mistakes, in One Chart

No one is immune to errors, including the best investors in the world. Fortunately, investing mistakes can provide valuable lessons over time, providing investors an opportunity to gain insights into investing—and build more resilient portfolios.

20 Investment Mistakes to Avoid →

20 Investment Mistakes to Avoid →Which Cities Have Bubble Risk in Their Property Markets?

Despite higher mortgages and sharply correcting prices, some cities’ property markets are still in bubble-risk territory.

The UBS Global Real Estate Bubble Index →

The UBS Global Real Estate Bubble Index →Charted: Retirement Age by Country

The retirement landscape can look completely different depending on what country you’re in. And charting the retirement age by country reveals a lot of differences in the the makeup of a labor force, both for economic and cultural reasons.

Exploring retirement age trends around the globe →

Exploring retirement age trends around the globe →Ranked: Median Student Debt for a U.S. College Degree

According to the Federal Reserve, student loans added up to $1.6 trillion in Q2 2023, making them the third largest category of U.S. household debt behind auto loans ($1.8 trillion) and mortgages ($12 trillion).

The Visual Capitalist ranks student debt by U.S. college degrees →

The Visual Capitalist ranks student debt by U.S. college degrees →Visualizing the Top Countries by Wealth per Person

When looking at wealth per person on a country-by-country basis, is it more important to look at median wealth or average wealth?

See how you compare to the rest of the world →

See how you compare to the rest of the world →Warren Buffett's Portfolio Visualized

Warren Buffet is probably best known for being one of the world’s most successful investors. See what Berkshire Hathaway are holding and learn from the legendary value investor known as the 'Oracle of Omaha'.

How They Make Money: Why the Oracle of Omaha tends to bet on the status quo →

How They Make Money: Why the Oracle of Omaha tends to bet on the status quo →Who appears on the most currency?

Queen Elizabeth II leads monarchs to the front of 1/3 of the world’s currency, followed by Vajiralongkorn, King of Thailand.

Monarchs and world leaders appear more frequently than other people →

Monarchs and world leaders appear more frequently than other people →World Risk Poll: How Long Can People Survive Without Income?

In the wake of natural disasters or economic shocks, a person could quickly be left without income, which is why financial security is such an important aspect of resilience. The Lloyd’s Register Foundation partnered with Gallup and polled 125,000 people from 121 countries, asking how long people could cover their basic needs without income

How Long Can People Survive Without Income? Assessing Financial Security →

How Long Can People Survive Without Income? Assessing Financial Security →Ranked: The 20 Best Franchises in the U.S.

The U.S. is famous for chain restaurants, franchised shops, and brand name hotels. One thing these franchises aim for is consistency in store feel, customer service, product offerings, and prices, no matter which state you’re in.

Best franchises in the U.S. worth owning, from Dunkin’ Donuts to ... →

Best franchises in the U.S. worth owning, from Dunkin’ Donuts to ... →How Long Does it Take to Double Your Money?

At first glance, a 7% return on your investment may not seem that impressive. Yet what if you heard that your money could double in roughly 10 years?

Why it Pays to Know the Math →

Why it Pays to Know the Math →The Monthly Cost of Buying vs. Renting a House in America

With home prices and mortgage rates both rising, the U.S. is now witnessing the biggest numerical gap in the monthly cost between owning a home and renting in over 50 years. Americans, however, have seen similar scenarios occur since the early 1980s.

See the difference of buying vs. renting a single-family residence in the U.S. since 1970, adjusted for inflation. →

See the difference of buying vs. renting a single-family residence in the U.S. since 1970, adjusted for inflation. →Just 7 Companies Dominate the Nasdaq 100

Launched in 1985, the Nasdaq 100 index tracks the performance of the largest, and most actively-traded, non-financial companies listed on the Nasdaq stock exchange.

Companies in the Nasdaq 100, by Weight →

Companies in the Nasdaq 100, by Weight →Visualizing U.S. Wealth by Generation

The distribution of wealth is an important measure of the economic power of each generation. In the U.S., for example, baby boomers own half of the nation’s $156 trillion in assets despite making up 21% of the country’s population.

Visualizing $156 Trillion in U.S. Assets, by Generation →

Visualizing $156 Trillion in U.S. Assets, by Generation →Timing the Market: Why It’s So Hard, in One Chart

Timing the market seems simple enough: buy when prices are low and sell when they’re high.

The Pitfalls of Timing the Market →

The Pitfalls of Timing the Market →The World’s Biggest Mutual Fund and ETF Providers

The global net assets of mutual fund and ETF providers totalled $38 trillion in 2022. Despite its massive size, the industry is dominated by a relatively small number of brands.

This graphic uses data from Morningstar to show the largest fund brands and their growth rates in 2022 →

This graphic uses data from Morningstar to show the largest fund brands and their growth rates in 2022 →The average monetary value of each type of person

Monarchs and world leaders appear more frequently than other people on the world’s currency. But, since many of them appear on multiple denominations, the average value of their notes and coins is lower than that of historians, mathematicians, and singers.

How do spies, historians, monarchs and athletes compare? →

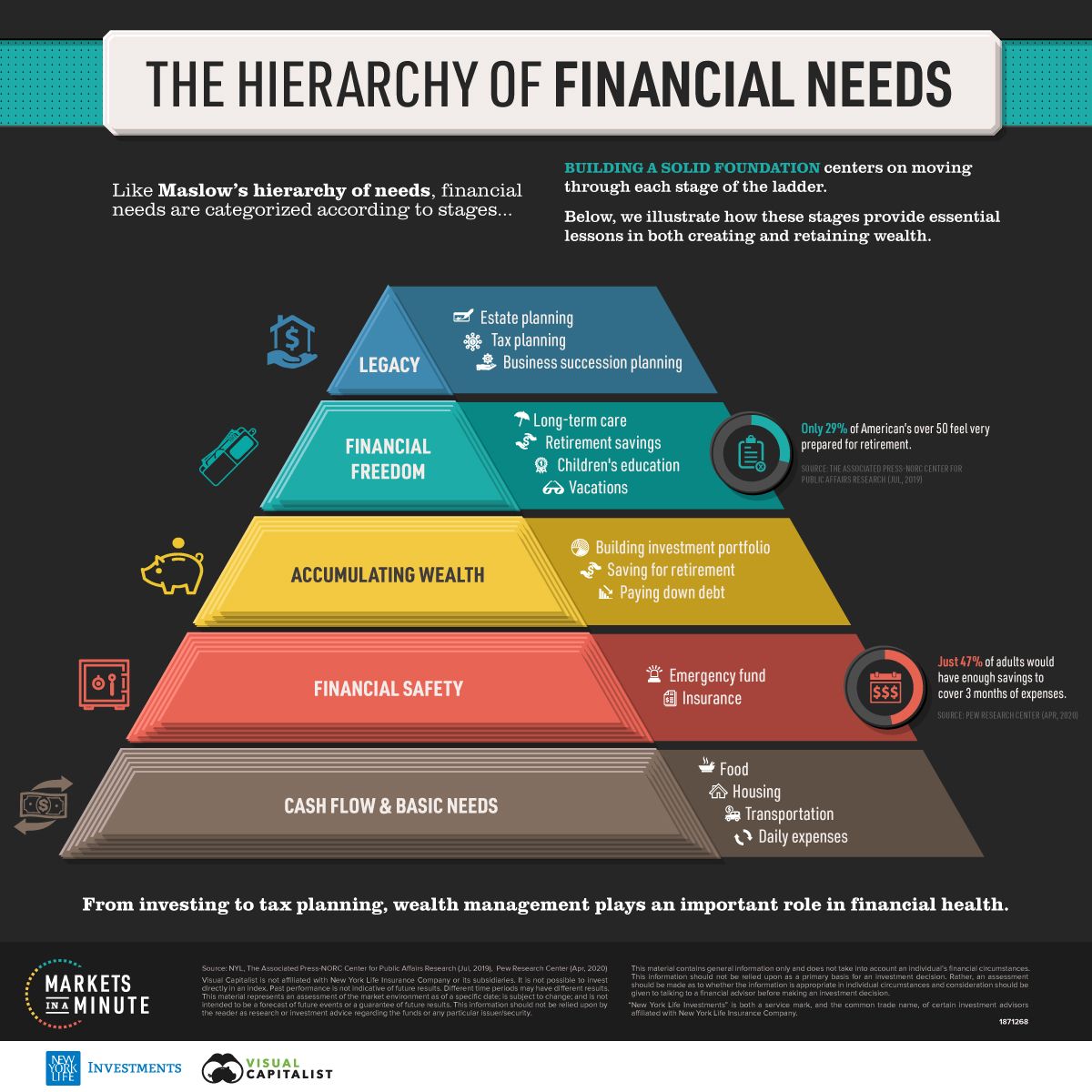

How do spies, historians, monarchs and athletes compare? →Visualizing the Hierarchy of Financial Needs

Behavioural scientist Abraham Maslow wrote “A Theory of Human Motivation” in 1943, arguing that humans worldwide are influenced by a “hierarchy of needs”. This theory organizes human needs across five levels, where needs in the lower end must be satisfied before progressing onto the next level.

See the steps to creating a strong financial foundation →

See the steps to creating a strong financial foundation →Global Distribution of Money

The fact that China, Japan, the United States, Germany, the United Kingdom, France, and India are the nations with the greatest concentrations of this wealth is not surprising. Actually, the combined wealth of just seven nations makes up 69% of the global total.

Do you know your Net Worth? Start tracking it today →

Do you know your Net Worth? Start tracking it today →Visualizing Annual Working Hours

Comparing the number of hours people work in different countries can provide insight into cultural work norms, economic productivity, and even labor laws.

Where does Canada rank? How do your working hours compare? →

Where does Canada rank? How do your working hours compare? →The most profitable U.S. companies, by sector

See the S&P 500 companies with the highest profits in their sector. Data is based on the fiscal year ending on or before January 31, 2023 across companies in the Fortune 500.

America’s most profitable companies, by sector →

America’s most profitable companies, by sector →See the Markets in a Minute

S&P 500 companies hold $7.1 trillion in assets, and account for close to 80% of available market capitalization on U.S. stock exchanges. The index serves as a barometer for the U.S. stock market, covering the largest public U.S. companies by market capitalization. Often, it reflects investor sentiment and is considered an indicator for U.S. economic health.

Visualizing Every Company on the S&P 500 Index →

Visualizing Every Company on the S&P 500 Index →The Most Expensive Starbucks Items in the World

Your daily coffee habit is probably costing you a lot more than you think. What if you skipped buying two coffees a week and invested that money?

The Price of (non-essential) Big Bucks Starbucks items in USD →

The Price of (non-essential) Big Bucks Starbucks items in USD →Ranked: The Cities with the Best Work-Life Balance in the World

"While some careers can be relatively stress-free, maintaining a healthy work-life balance can seem impossible for many. The easy access to technology, blurred boundaries around work and personal time, and fear of job loss push many to work overtime, and fail to use vacation time or sick leave."

How did Canadian cities measure up? →

How did Canadian cities measure up? →The Fastest Rising Asset Classes in 2023

Many corners of the market have shown resilience despite persistent inflation and slowing economic growth in 2023. U.S. equities, international equities, and a variety of bonds have seen positive returns so far this year.

The top-performing asset classes to date with data from BlackRock →

The top-performing asset classes to date with data from BlackRock →Charting the Number of Failed Crypto Coins

Ever since the first major crypto boom in 2011, tens of thousands of cryptocurrency coins have been released to market. And while some cryptocurrencies performed well, others have ceased to trade or have ended up as failed or abandoned projects. These graphics from CoinKickoff break down the number of failed crypto coins by the year they died, and the year they started. The data covers a decade of coin busts from 2013 through 2022.

The Number of Failed Crypto Coins, by Year (2013-2022) →

The Number of Failed Crypto Coins, by Year (2013-2022) →Just 20 Stocks Have Driven S&P 500 Returns So Far in 2023

Truman Du shows which stocks are making up the vast majority of S&P 500 returns amid AI market euphoria and broader market headwinds.

Tech and AI stocks have soared as ChatGPT became a household name in 2023 →

Tech and AI stocks have soared as ChatGPT became a household name in 2023 →How Much Should You Tip In Each Country?

How much should you tip when traveling abroad? The answer can vary wildly depending on the country and what type of service you are using.

Servers and bartenders depend on tips to supplement wages →

Servers and bartenders depend on tips to supplement wages →Charting the Relationship Between Wealth and Happiness, by Country

Throughout history, the pursuit of happiness has been a preoccupation of humankind. Of course, we humans are not just content with measuring our own happiness, but also our happiness in relation to the people around us—and even other people around the world.

Does money really buy happiness? Let’s find out →

Does money really buy happiness? Let’s find out →How Gen Z Feels About Its Financial Future

Gen Z is an optimistic and driven generation. Many young people in this generational cohort are turning to entrepreneurship and side hustles as a way to supplement their income and build a brighter future.

Gen Zers have a more positive outlook on their financial well-being than their millennial or Gen X peers →

Gen Zers have a more positive outlook on their financial well-being than their millennial or Gen X peers →Mapped: How Global Housing Prices Have Changed Since 2010

Houses fulfill a rare mix of necessity, utility, sentimentality, and for many, also act as a primary investment to build wealth. And it’s that last angle, combined with increasing demand in many countries, that is driving housing prices skyward.

See how Canada measures up →

See how Canada measures up →How much more are groceries costing you this year?

Mapped: Which Countries Have the Highest Inflation?

See how Canada compares to the rest of the world →

See how Canada compares to the rest of the world →How much do you spend on your daily coffee?

Mapped: The Price of Starbucks Coffee, by Country

Do you know how much you spend on daily coffee? See how you compare →

Do you know how much you spend on daily coffee? See how you compare →