Personal Finance

Better Finances for a Better You

Topic: "Investments"

← Curating the web to find the most interesting and helpful

information about your money.

Word of the week

Registered Investment Advisor (RIA)

A registered investment advisor (RIA) is a trusted financial professional or firm dedicated to guiding clients in making informed decisions about securities investments. They offer in-depth advice and actively manage a client's investment portfolio.

Registered Investment Advisor (RIA): Definition, Duties, and Responsibilities →Investing

10 Tips for Successful Long-Term Investing

A Guide to Smart Investing Strategies That Actually Work

Certain tried-and-true principles can help investors boost their chances for long-term success →Investing

Investing in Travel and Tourism Stocks by Rachel Warren

It's easy to be bullish on travel and tourism stocks. Over the last few years, travel and tourism have boomed back as a top growth industry. Who couldn't use a vacation right now?

Best Travel & Tourism Stocks to Buy in 2025 →Investing

Warren Buffett’s Advice for Millennials Who Want To Get Rich by Caitlyn Moorhead

When it comes to seeking out a financial advisor, you could do worse than to invest your time learning from one of the richest men in the world.

Here is Buffett’s advice for millennials aiming to build wealth →Did you know?

Have you heard of the Rule of 72? It’s a quick way to see how fast your money can double. Just divide 72 by your expected interest rate, and you'll know how many years it will take. This simple formula can help you make smarter financial choices!

The Rule Of 72 Chart For Investing →Word of the week

Rule of 72

The Rule of 72 is a simple way to estimate how long it takes for an investment to double. By dividing 72 by the annual rate of return, investors can find an approximate time frame. This method is most accurate with low interest rates. For a more precise calculation that includes compound interest, the Rule of 69.3 can be used.

The Rule of 72: Definition, Usefulness, and How to Use It →Infographic of the week

Visualizing Major Asset Class Returns in 2024

Bitcoin surged to all-time highs, gold saw its best performance in 14 years, and the U.S. dollar rallied thanks to a strong U.S. economy. Meanwhile, the S&P 500 saw its best two-year run in over 25 years. On the flip side, bonds experienced lackluster performance amid reflationary concerns. This graphic shows major asset class returns in 2024, based on data from TradingView.

Bitcoin and Gold Outperform in 2024 →

Bitcoin and Gold Outperform in 2024 →Investing

Five Principles of Successful Investing

1. Invest early 2. Invest regularly 3. Invest enough 4. Have a plan 5. Diversify your portfolio

Five basic principles on how to invest and avoid costly mistakes. Learn more from RBC →Investing

5 Things Frugal People Always Do With Their Investments by John Csiszar

1) Avoid Commissions 2) Use Passive Investments 3) Find the Lowest Cost Variations 4) Trade Infrequently 5) Check Regularly, but Infrequently

When shopping for anything, including investments, you should never confuse “frugal” with “cheap.” →Investing

Warren Buffett’s 10 Best Lessons on How To Be Successful in Investing Story by Jacob Wade

Warren Buffett is worth almost $150 billion and is one of the best American investors of all time. He’s shared his wisdom with investors over the years, helping new and experienced investors learn to “be like Buffett.”

Here are 10 investing tips from the “Oracle of Omaha” himself to help you build your wealth →Infographic of the week

Which Assets Are Most Correlated to the USD?

Building a well-balanced, diversified portfolio involves including assets with varying correlations. The U.S. dollar (USD), with its weak or negative correlations to other assets, can be a valuable addition to investors’ portfolios. This graphic, created in partnership with OANDA, illustrates the USD’s correlations with other assets and indices. This insight can provide assistance for evaluating the role of USD in investment portfolios.

Which Assets Are Most Correlated to the USD? →

Which Assets Are Most Correlated to the USD? →Investing

5 rules for investing in retirement by Merrill Lynch

1. Review your asset allocation with new risks in mind 2. Prioritize your immediate cash needs 3. Don’t abandon stocks 4. Prepare for volatility, especially early in your retirement 5. Stick to your plan — and review it regularly

What's in, What's out of your portfolio after you retire →Investing

10 Tips for Successful Long-Term Investing

While the stock market is riddled with uncertainty, certain tried-and-true principles can help investors boost their chances for long-term success.

Tips that can help you prevent mistakes and hopefully generate some profits By THE INVESTOPEDIA TEAM →Infographic of the week

Charted: The Most Popular Investing Strategies, by Generation

When it comes to investing, each generation has their own mix of strategies, and younger generations like to try a bit of everything.

How Do Different Generations Invest Their Money? →

How Do Different Generations Invest Their Money? →Investing

How To Invest In Real Estate By Miranda Marquit

There are an endless variety of ways to invest in real estate, from taking out a home mortgage to building a property empire that spans the country. While the latter is probably out of reach for most of us, there’s no shortage of other options.

Here are five strategies for adding real estate exposure to your investments →Word of the week

Stock

A stock is a type of investment that is mostly offered on stock markets and signifies the holder's proportional ownership in the issuing company.

What Are Stocks? How Do They Work? →Investing

5 Simple Ways to Invest in Real Estate By Andrew Beattie

1. Rental Properties 2. Real Estate Investment Groups 3. House Flipping 4. Real Estate Investment Trusts (REITs) 5. Online Real Estate Platforms

Here's how—from buying rental property to REITs and more →Infographic of the week

Visualized: The Growth of Clean Energy Stocks

Over the last few years, energy investment trends have shifted from fossil fuels to renewable and sustainable energy sources. Long-term energy investors now see significant returns from clean energy stocks, especially compared to those invested in fossil fuels alone. For this graphic, Visual Capitalist has collaborated with EnergyX to examine the rise of clean energy stocks and gain a deeper understanding of the factors driving this growth.

The Growth of Clean Energy Stocks →

The Growth of Clean Energy Stocks →Infographic of the week

Visualizing the Growth of $100, by Asset Class

Which major asset class has generated the strongest returns over the long run? How do the returns of investments like bonds and real estate actually stack up? To put investment returns in perspective, this graphic shows the growth of $100 by asset class over the long term, based on data from Aswath Damodaran at NYU Stern.

Comparing Asset Class Returns →

Comparing Asset Class Returns →Investing

10 Tips for Successful Long-Term Investing

While the stock market is riddled with uncertainty, certain tried-and-true principles can help investors boost their chances for long-term success.

By THE INVESTOPEDIA TEAM, 10 Tips for Successful Long-Term Investing →Investing

Should you put your money in a long-term CD or invest it? Here’s what to consider by Elizabeth Gravier

With savings rates still high and more interest rate cuts possible in 2024, savers today are giving a lot of attention to CDs. A certificate of deposit lets you lock in a fixed interest rate for a fixed amount of time. That’s an attractive option in today’s market, where savers can find CD rates of up to 5.66%. That far outpaces the current inflation rate of 3.4%, so your money is protected from being devalued.

CD or the market? What to consider first →Infographic of the week

Decision Paralysis: The Rise to One Million Investment Choices

There were just over 30,000 managed investment products in 2002, but the choices grew rapidly in the years that followed. As of June 30, 2023, there were more than 742,000 products available.

The rise in investment products over time, and how financial advisors can help →

The rise in investment products over time, and how financial advisors can help →Investing

How to Invest in Index Funds in 2024 from the Motley Fool

An index fund is an investment that tracks a market index, typically comprising stocks or bonds. Index funds generally invest in all the components of the index they track and have fund managers whose job is to make sure that the index fund performs the same as the index.

Why invest in index funds? →Investing

A beginner’s guide to investing in the stock market

Investing can be one of the more complex concepts in personal finance. But it’s also one of the key cornerstones to financial independence and wealth building.

Kevin L. Matthews II on how to start investing and decide on your investing goals →Investing

Best Investments for Beginners

There are several options considered the best investments for beginners that suit a range of goals, budgets, and comfort levels. This guide will cover the most common options, but a financial advisor can help you identify your best options and provide support while you navigate your first investments.

Investing can seem scary and intimidating, especially to first-time investors these tips can help →Word of the week

Rebalancing

Rebalancing entails adjusting your investment holding to desired percentages for your stocks and bonds. Let's take an example where your target allocation is 20% bonds, 20% cash, and 60% stocks. You may now have a 70 percent stock, 10 percent bond, and 20 percent cash allocation if the stock market has done really well over the last year. You can sell some stocks and reinvest the proceeds in bonds to rebalance your portfolio, or you can add more bonds to the portfolio to restore its original balance.

How To Rebalance Your Investment Portfolio →Saving

You don't need to be an expert to grow a nest egg. We'll cover how to build your portfolio, when to sell (or not sell) stocks and how to avoid fees.

NPR Life Kit Podcast: Investing for beginners →

NPR Life Kit Podcast: Investing for beginners →Investing

10 Best AI Stocks Of February 2024 by Cory Mitchell

Forbes Advisor has identified 10 of the best AI stocks. They each shine for different reasons. Some are more stable with great earnings growth, while others are newer and more speculative but have produced big returns. There are AI stocks here to suit all types of investors.

AI is a growing field, and AI-related ETFs have outpaced the S&P 500 by a significant margin year to date →Investing

10 Best Dividend Stocks Of February 2024 by Cory Mitchell

Dividend investing provides investors with steady cash flow over the long term. When you reinvest dividend income, the magic of compounding can turbocharge your returns. Over the last century, dividend payments accounted for about 40% of the total return of the S&P 500.

These companies have boosted annual dividend payouts for at least 10 years with attractive yields →Did you know?

The Philadelphia Stock Exchange (PHLX), established in 1790, is older than the New York Stock Exchange (NYSE), and even as late as 1815, London banks looked to Philadelphia rather than New York to buy American securities.

How New York Became the Center of American Finance →Infographic of the week

Charted: Investment Preferences by Generation in the U.S.

Different generations grow up with different values and different economic realities, causing investment preferences by generation to vary across the board. The above graphic shows how different generations invest—from millennials to boomers—based on June 2023 survey data from Charles Schwab.

The Visual Capitalist: Investment Preferences by Generation →

The Visual Capitalist: Investment Preferences by Generation →Investing

10 Top Tech Stocks Of February 2024 by Dock David Treece

The best tech stocks come from companies that are building the future. Whether they manufacture sleek mobile devices or develop the digital services you can’t live without, fast-growing technology stocks can set portfolios into hyperdrive.

The 10 largest tech sector companies profiled →Investing

What are ETFs and Should You Invest in Them? by Elizabeth Gravier

There are so many ways to invest your money to build your wealth. From stocks to bonds to index funds, there’s a wide range of investment vehicles for every kind of investor depending on their goals. A common choice for beginner investors who want exposure to the overall stock market is to put money into an exchange-traded fund or ETF.

Here's what you should know about investing with ETFs. →Investing

Three Investing Trends for 2024 and Beyond

Longevity, decarbonization and technology disruption could provide long-term investment opportunities.

Michael Zezas of Morgan Stanley on investing trends for 2024 →Investing

This Money Checklist Will Help You Crush 2024

Money.com provide a 10-step guide to crushing your financial goals in 2024 (and beyond). For expert insights into the housing market, ways to save money on EVs and more.

What do you hope to accomplish in 2024? →Infographic of the week

Tech Giants’ Stock Performance: A Three-Year Review (2020-2023)

In the last three years tech giants like Apple, Google, and Microsoft navigate through market volatility due to the global pandemic. In 2020, the pandemic led to a market selloff, but companies like Zoom and Shopify experienced growth due to increased demand during lockdowns.

Maureen Okonkwo's Viz at Tableau Public →

Maureen Okonkwo's Viz at Tableau Public →Investing

2023 in review: Rates, rallies and reflections

The U.S. Fed finishes 2023 with a bang, plus 40 notable events that helped shape markets this year.

Madison Faller Global Investment Strategist at JP Morgan →Investing

You may want to change your investing strategy in 2024

Calling the remarkable past few weeks on Wall Street a Santa Claus rally or an end-of-year winning streak would be an understatement.

Nicole Goodkind from CNN on your investment strategy for 2024 →Word of the week

Time Value of Money (TVM)

The idea that money that is available now is worth more than the same amount in the future is known as the time value of money, or TVM. This is due to the fact that money that is invested has the ability to grow, and the longer it is invested, the more value it will gain. Money acquired later is viewed as having less value since it has less time to increase through investments.

Model and forecast the growth of your money. Define projected growth rates & visualize likely scenarios →Investing

Ways to supercharge your CD investments

CDs offer a guaranteed interest rate that’s typically higher than a savings account, and you get the safety of FDIC insurance to ensure your money will be there when you need it. They’re not right for every situation, but they can be an effective way to save for short-term goals or create a predictable stream of income.

How to find the best CDs to invest in →Infographic of the week

Visualizing 30 Years of Investor Sentiment

The link between investor sentiment and the stock market is not linear. In fact, many consider extreme sentiment readings as a contrarian indicator. If sentiment swings sharply in one direction, some investors may consider this a signal to do the reverse.

Investor sentiment and U.S. stock prices over modern history →

Investor sentiment and U.S. stock prices over modern history →Investing

How to Invest in ETFs for Beginners

Exchange-traded funds, or ETFs, are an easy way to begin investing. ETFs are fairly simple to understand and can generate impressive returns without much expense or effort.

Here’s what you should know about ETFs and how they work →Infographic of the week

The 20 Most Common Investing Mistakes, in One Chart

No one is immune to errors, including the best investors in the world. Fortunately, investing mistakes can provide valuable lessons over time, providing investors an opportunity to gain insights into investing—and build more resilient portfolios.

20 Investment Mistakes to Avoid →

20 Investment Mistakes to Avoid →Investing

What Is the Fear and Greed Index?

The Fear and Greed Index is a tool developed by CNN (yes, the news network) to help gauge what factors are driving the stock market at a given time.

Guide to the Fear and Greed Index →Word of the week

Annuity

An annuity is a type of insurance contract in which the insured (you) and the insurer (insurance firm) agree that the insurer will pay you either on a regular basis or one-time disbursements to you as a payout for your contributions. Usually, people utilize an annuity as a retirement income source.

Use our free retirement calculator to see how an annuity make get you closer to your goals →Serious stuff

Should I still be investing in this uncertain stock market? Uncertainty is a normal – even necessary – part of investing, but it becomes a problem when people spend so much time worrying that they miss out on market returns.

Four tips for nervous investors from Benjamin Felix →Word of the week

Financial Exposure

Investor risk, which is defined as the possible loss an investor may incur by investing, is referred to as financial exposure. Investors use strategies like investment hedging and diversification to try to reduce their financial exposure.

Take your first steps into the investment world without risking losing any money →Investing

ScotiaFunds: 5 timeless tips on managing market ups and downs

1. Keep calm and carry on 2. Stay invested…it’s time, not timing 3. Manage risk, don't avoid it 4. Put diversification to work 5. Take advantage of dollar-cost averaging

Learn more from their easy to read resource →Word of the week

Diversification

A fundamental investing strategy that distributes investment funds among multiple asset classes is diversification.

What Is Diversification? Definition as Investing Strategy →Investing

How to Invest in Bonds

Bonds are a way for an organization to raise money. Let's say your town asks you for a certain investment of money. In exchange, your town promises to pay you back that investment, plus interest, over a specified period of time.

A Beginner's Guide to Buying Bonds →Infographic of the week

Warren Buffett's Portfolio Visualized

Warren Buffet is probably best known for being one of the world’s most successful investors. See what Berkshire Hathaway are holding and learn from the legendary value investor known as the 'Oracle of Omaha'.

How They Make Money: Why the Oracle of Omaha tends to bet on the status quo →

How They Make Money: Why the Oracle of Omaha tends to bet on the status quo →Investing

How to Invest Like Warren Buffett

Want to emulate Buffett’s investment strategy? Morningstar has compiled work on the approach he and partner Charlie Munger have pursued at Berkshire Hathaway. (Stock symbols BRK.A and BRK.B)

Delve into Warren Buffett’s investment strategy →Word of the week

Asset Allocation

Asset allocation is where you choose to put your money. The three primary asset classes are stocks, bonds, and cash. Choose those that best match your goals, risk tolerance, and time schedule.

Neontra aggregates and tracks all your assets in one place so you can monitor your allocation easily →Infographic of the week

Ranked: The 20 Best Franchises in the U.S.

The U.S. is famous for chain restaurants, franchised shops, and brand name hotels. One thing these franchises aim for is consistency in store feel, customer service, product offerings, and prices, no matter which state you’re in.

Best franchises in the U.S. worth owning, from Dunkin’ Donuts to ... →

Best franchises in the U.S. worth owning, from Dunkin’ Donuts to ... →Infographic of the week

How Long Does it Take to Double Your Money?

At first glance, a 7% return on your investment may not seem that impressive. Yet what if you heard that your money could double in roughly 10 years?

Why it Pays to Know the Math →

Why it Pays to Know the Math →Infographic of the week

Just 7 Companies Dominate the Nasdaq 100

Launched in 1985, the Nasdaq 100 index tracks the performance of the largest, and most actively-traded, non-financial companies listed on the Nasdaq stock exchange.

Companies in the Nasdaq 100, by Weight →

Companies in the Nasdaq 100, by Weight →Infographic of the week

Timing the Market: Why It’s So Hard, in One Chart

Timing the market seems simple enough: buy when prices are low and sell when they’re high.

The Pitfalls of Timing the Market →

The Pitfalls of Timing the Market →Did you know?

The first War Savings Certificates and Victory Bonds were issued in Canada during the First and Second World Wars. They went towards paying for the war effort.

Browse through the gallery and view the timeline to learn about the History of Canada Savings Bonds. →Word of the week

Interest

Typically, interest is paid on deposits to savings accounts. Your savings will increase as a result of the interest you earn on money you save, particularly if you have a higher-interest savings account. Simple interest - is paid on some investments and does not take into account the interest that has been added to the account; rather, it calculates interest just on the original amount. These investments often have a slightly higher interest rate. Compound interest - is the interest on savings calculated on both the initial principal and the accumulated interest from previous periods. Compound interest is the norm for savings accounts.

See an example of how simple and compound interest differ →Infographic of the week

The World’s Biggest Mutual Fund and ETF Providers

The global net assets of mutual fund and ETF providers totalled $38 trillion in 2022. Despite its massive size, the industry is dominated by a relatively small number of brands.

This graphic uses data from Morningstar to show the largest fund brands and their growth rates in 2022 →

This graphic uses data from Morningstar to show the largest fund brands and their growth rates in 2022 →Word of the week

Bonds

Governments and businesses both issue bonds as a form of investment. In exchange for a predetermined rate of return, you lend money to these organizations when you purchase a bond. Although historically yielding less than stocks, bonds are thought to be a safer kind of investment.

How to Buy Bonds in Canada →Investing

Motley Fool outlines Warren Buffett's investing philosophy in 9 steps

1. Look for a margin of safety 2. Focus on quality 3. Don't follow the crowd 4. Don't fear market crashes and corrections 5. Approach your investments with a long-term mindset 6. Don't be afraid to sell if the scenario changes 7. Learn the basics of value investing 8. Understand compounding 9. Research and reflect

How to Invest Like Warren Buffett →Infographic of the week

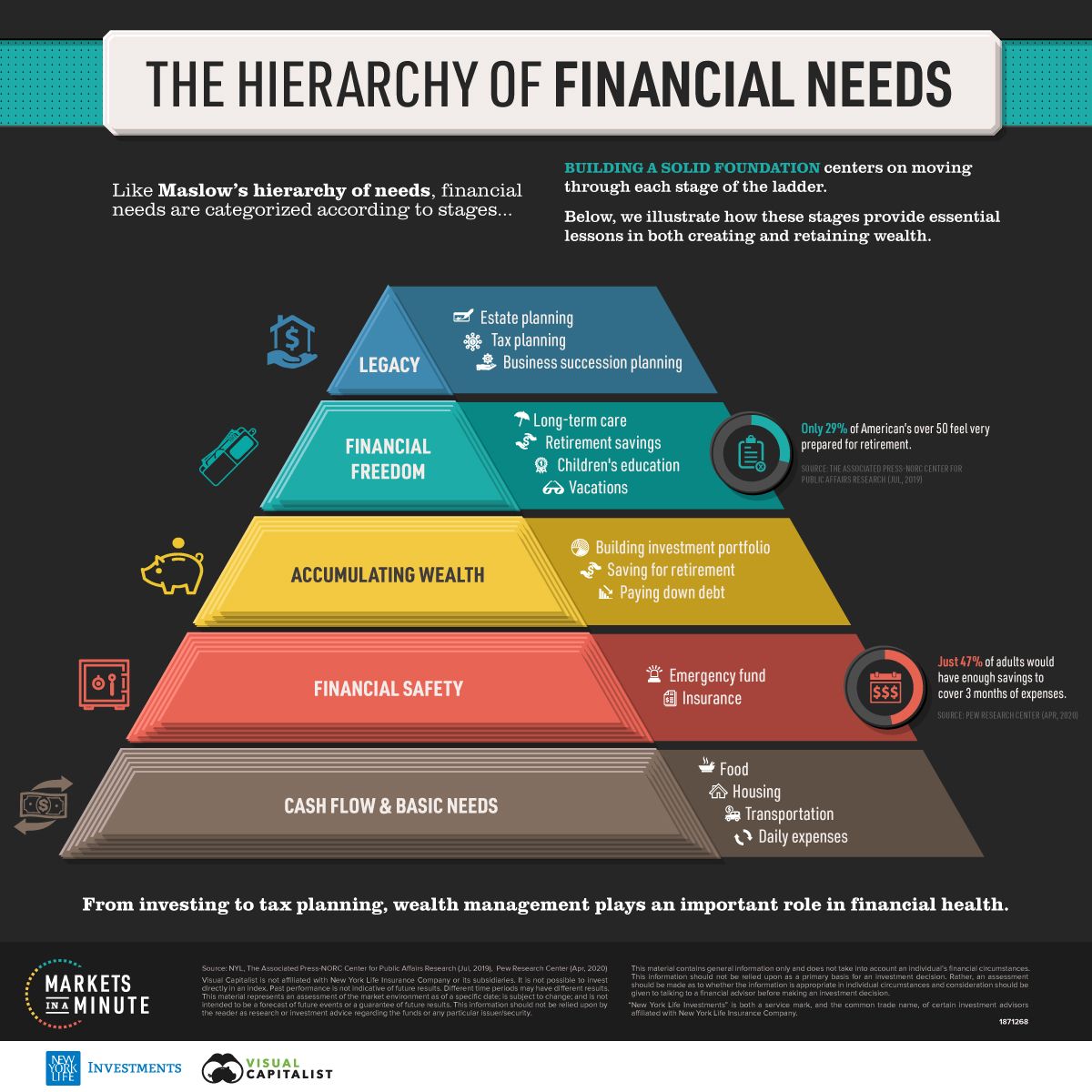

Visualizing the Hierarchy of Financial Needs

Behavioural scientist Abraham Maslow wrote “A Theory of Human Motivation” in 1943, arguing that humans worldwide are influenced by a “hierarchy of needs”. This theory organizes human needs across five levels, where needs in the lower end must be satisfied before progressing onto the next level.

See the steps to creating a strong financial foundation →

See the steps to creating a strong financial foundation →Investing

Financial advisors agree: These are the 3 best investing tips for beginners

CNBC Select shares three tips for any beginner investor just starting out. 1) Audit your finances before you even start to invest 2) Utilize retirement accounts as much as you can 3) Know you don’t have to be an expert

If you’re just getting into investing, read more →Investing

3 common mistakes investors make — and how to avoid them

In our daily lives, we know it’s hard to break bad habits, like eating too much junk food. The same is true for investing. Just as understanding which foods are better for you, knowledge is power when it comes to your portfolio.

Nobody’s perfect, especially when it comes to investing →Investing

Investing can seem intimidating

Fortune.com outlines how to get started: - Decide your investment goals - Select investment vehicle(s) - Calculate how much money you want to invest - Measure your risk tolerance - Consider what kind of investor you want to be - Build your portfolio - Monitor and rebalance your portfolio over time

A beginner’s guide to investing in the stock market →Infographic of the week

The most profitable U.S. companies, by sector

See the S&P 500 companies with the highest profits in their sector. Data is based on the fiscal year ending on or before January 31, 2023 across companies in the Fortune 500.

America’s most profitable companies, by sector →

America’s most profitable companies, by sector →Investing

Millennials: 4 Tips to Start Investing Today

1. Build your credit 2. Open a TFSA 3. Invest what you can 4. Set some goals

Here are some tips to get started from Motley Fool →Infographic of the week

The Fastest Rising Asset Classes in 2023

Many corners of the market have shown resilience despite persistent inflation and slowing economic growth in 2023. U.S. equities, international equities, and a variety of bonds have seen positive returns so far this year.

The top-performing asset classes to date with data from BlackRock →

The top-performing asset classes to date with data from BlackRock →Investing

Investing for Young Canadians

If you’re a young person thinking about making your first investment but not sure where to begin, you’re not alone.

RRSP, TFSA or FHSA? Young Canadians looking to invest face wide range of options →Investing

9 easy steps to start investing in Canada:

1. Assess your risk tolerance 2. Choose Your Investing Style 3. Decide How Much You Can Invest 4. Pick the Right Kind of Stock Investments 5. Choose a broker 6. Open the right investment account 7. Diversify Your Stocks 8. Keep a Steady Eye on Your Portfolio 9. Invest Consistently for the Long-Term

How to Start Investing in Canada: 9 Steps to Success →Word of the week

Exchange-Traded Fund (ETF)

An ETF is essentially a basket of investments such as stocks or bonds. In this sense they’re similar to mutual funds, but unlike mutual funds, shares of ETFs can be traded throughout the day on an exchange, much like an individual stock.

Learn about the benefits of ETFs →Infographic of the week

Just 20 Stocks Have Driven S&P 500 Returns So Far in 2023

Truman Du shows which stocks are making up the vast majority of S&P 500 returns amid AI market euphoria and broader market headwinds.

Tech and AI stocks have soared as ChatGPT became a household name in 2023 →

Tech and AI stocks have soared as ChatGPT became a household name in 2023 →Investing

ETF vs Index Fund: Which Should Canadians Invest In?

Learn the differences between ETFs and index funds and determine which fund is right for you.

ETF vs Index Fund →Word of the week

GIC (Guaranteed Investment Certificate)

"Guaranteed Investment Certificates (GICs) and term deposits are secured investments. This means that you get back the amount you invest at the end of your term. The key difference between a GIC and a term deposit is the length of the term. Term deposits generally have shorter terms than GICs."

Learn about the key details before buying a GIC →← Curating the web to find the most interesting and helpful information about your money.